The Basic Principles Of Feie Calculator

Excitement About Feie Calculator

Table of ContentsAll about Feie CalculatorFeie Calculator Fundamentals ExplainedThe 9-Minute Rule for Feie CalculatorA Biased View of Feie CalculatorRumored Buzz on Feie Calculator

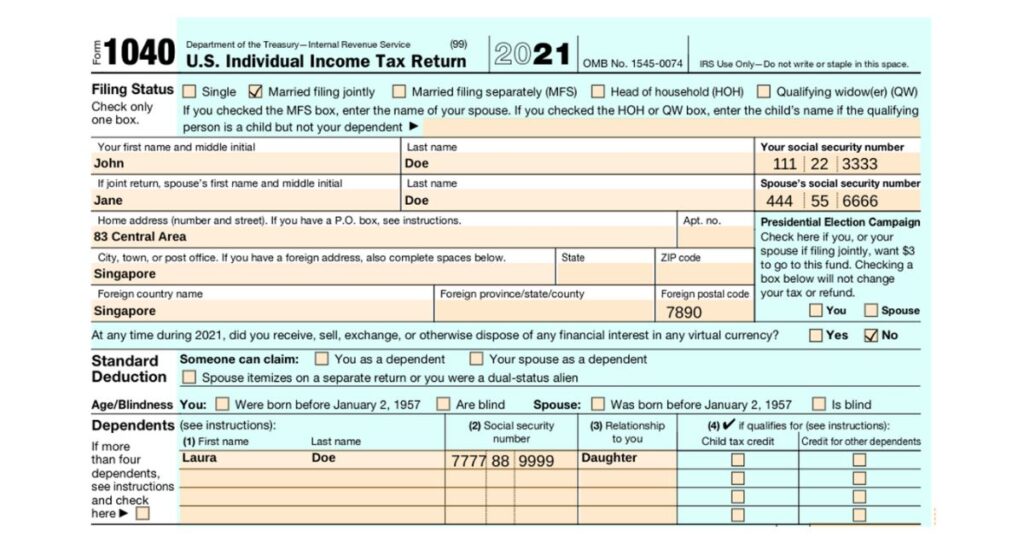

He sold his U.S. home to develop his intent to live abroad permanently and used for a Mexican residency visa with his spouse to assist satisfy the Bona Fide Residency Examination. Neil points out that acquiring property abroad can be testing without first experiencing the place."We'll certainly be outside of that. Also if we come back to the US for medical professional's appointments or company telephone calls, I doubt we'll spend greater than one month in the United States in any provided 12-month duration." Neil highlights the importance of stringent monitoring of united state sees (Form 2555). "It's something that individuals require to be actually diligent concerning," he says, and recommends expats to be careful of typical blunders, such as overstaying in the united state

Feie Calculator Can Be Fun For Anyone

tax obligations. "The reason U.S. taxes on worldwide income is such a big deal is because lots of people neglect they're still based on U.S. tax also after transferring." The U.S. is just one of the few countries that tax obligations its citizens no matter where they live, suggesting that also if an expat has no income from united state

tax return. "The Foreign Tax obligation Debt permits people functioning in high-tax nations like the UK to offset their united state tax obligation obligation by the amount they have actually currently paid in tax obligations abroad," says Lewis. This ensures that deportees are not tired two times on the same earnings. Nevertheless, those in low- or no-tax nations, such as the UAE or Singapore, face extra hurdles.

Feie Calculator Things To Know Before You Get This

Below are a few of one of the most regularly asked questions about the FEIE and other exemptions The Foreign Earned Income Exclusion (FEIE) allows U.S. taxpayers to leave out approximately $130,000 of foreign-earned revenue from government revenue tax obligation, lowering their U.S. tax obligation. To qualify for FEIE, you need to meet either the Physical Existence Test (330 days abroad) or the Bona Fide Residence Examination (confirm your key home in a foreign country for a whole tax obligation year).

The Physical Visibility Examination requires you to be outside the U.S. for 330 days within a 12-month duration. The Physical Visibility Examination likewise needs U.S. taxpayers to have both an international income and a foreign tax home. A tax obligation home is defined as your prime location for organization or work, Full Article no matter of your household's home.

The Facts About Feie Calculator Revealed

An income tax obligation treaty between the united state and one more country can assist protect against dual tax. While the Foreign Earned Revenue Exemption lowers taxable revenue, a treaty might supply fringe benefits for eligible taxpayers abroad. FBAR (Foreign Checking Account Report) is a needed declare united state residents with over $10,000 in foreign monetary accounts.

Qualification for FEIE depends on meeting particular residency or physical visibility examinations. He has over thirty years of experience and currently specializes in CFO services, equity compensation, copyright taxation, marijuana tax and divorce related tax/financial planning issues. He is a deportee based in Mexico.

The international earned earnings exemptions, sometimes referred to as the Sec. 911 exclusions, omit tax on earnings gained from working abroad.

Get This Report on Feie Calculator

The revenue exclusion is currently indexed for rising cost of living. The maximum annual revenue exemption is $130,000 for 2025. The tax obligation advantage excludes the income from tax at bottom tax rates. Previously, the exclusions "came off the top" minimizing revenue based on tax obligation on top tax obligation prices. The exemptions may or might not lower revenue made use of for various other objectives, such as individual retirement account limits, youngster credit histories, individual exemptions, and so on.

These exemptions do not spare the incomes from United States tax however merely provide a tax obligation decrease. Keep in mind that a bachelor working abroad for all of 2025 that earned about $145,000 without other income will certainly have taxed revenue reduced to absolutely no - properly the exact same response as being "tax obligation complimentary." The exclusions are calculated on a day-to-day basis.